Good Morning, Chop Family!

2025 is almost over. Finish any unfinished projects or promises that you made to yourself, and get ready for the future. Give yourself grace, but also hold yourself accountable.

📈 Trending Headlines

Donald Trump has declared the airspace over Venezuela closed.

In a tweet that sent fresh geopolitical jitters across Latin America and global markets, the U.S. president warned airlines to avoid flying over Venezuela.

The U.S. has been bombing Venezuelan ships suspected of smuggling drugs to America.

OPEC+ announced it will keep oil output for Q1 2026 unchanged, suggesting producers are wary of a looming global supply glut even as markets wait on demand signals.

OPEC pumps half of the world’s oil supply and hasa major influence on global supply.

MARKET MOVES

BUSINESS

Nairobi Expressway

Bring Back the Belt

Kenya just swerved back into Beijing’s lane (trap?), green-lighting a $1.5 billion highway expansion with two Chinese SOEs after earlier Western-leaning plans fell apart.

The project will widen the Mombasa–Nairobi–western corridor, using a 75% debt, 25% equity PPP model and a 28-year toll concession, with Kenya’s pension fund riding in first position on the equity side.

For China, it’s a quiet reboot of its African playbook: after stalling parts of the Belt and Road railway to Uganda over debt worries, this deal signals a more cautious, toll-backed BRI 2.0 rather than the old “cheap debt, big cheque” deals.

Could this be the new method to resurrect large infrastructure projects across Africa, one that won’t crush economies with debt, but rather utilizes strategic partnerships and toll revenue? We are watching, waiting, and rooting.

Barrick v Mali

The Canadian mining giant, Barrick, has come to an agreement with the Malian government regarding mining disputes and the recent jailing of Barrick employees in Mali.

Mali is home to two of the world’s largest gold mines, Loulo and Gounkoto, which generate close to a billion dollars for the Canadian company.

The recent agreement has Barrick paying $430 million to Mali, and Barrick will regain control over the operations in the mines, and the four employees will be released.

Drastic measures are sometimes needed to rewrite the narrative, and change the trajecgtory of lucarative sectgors like mining and big oil. African nations need to be in charge, and not be beholden to outside entities.

However, will the Juntas and regimes in charge be responsible with the new rules, or will they continue to plunder from within. Not sure which is worse, getting robbed by your own, or an outsider.

FINANCE

Cash Trap

Senegal just admitted it is thirsty for cash, and the IMF is measuring the jug. Finance Minister Cheikh Diba told parliament the country needs around 6,000 billion CFA francs (about $10.6 billion) a year in financing, a “very large amount” the IMF doubts is sustainable given the debt load and a pile of previously hidden obligations.

Dakar, for its part, insists it can pull it off by refinancing expensive debt, stretching maturities, and freeing up over 500 billion CFA francs in budget space for 2025, but investors weren’t convinced, and Senegal’s eurobonds promptly slipped a couple of cents as the liquidity drama hit the screens.

Sounds like desperation. The last administration in Dakar failed to report or reveal previous debt obligations, and this is a major red flag. So it makes sense that the IMF is doubtful that huge amounts of new debt are the answer for a nation with a poor track record.

REAL ESTATE

🏢 South Africa’s Office Comeback

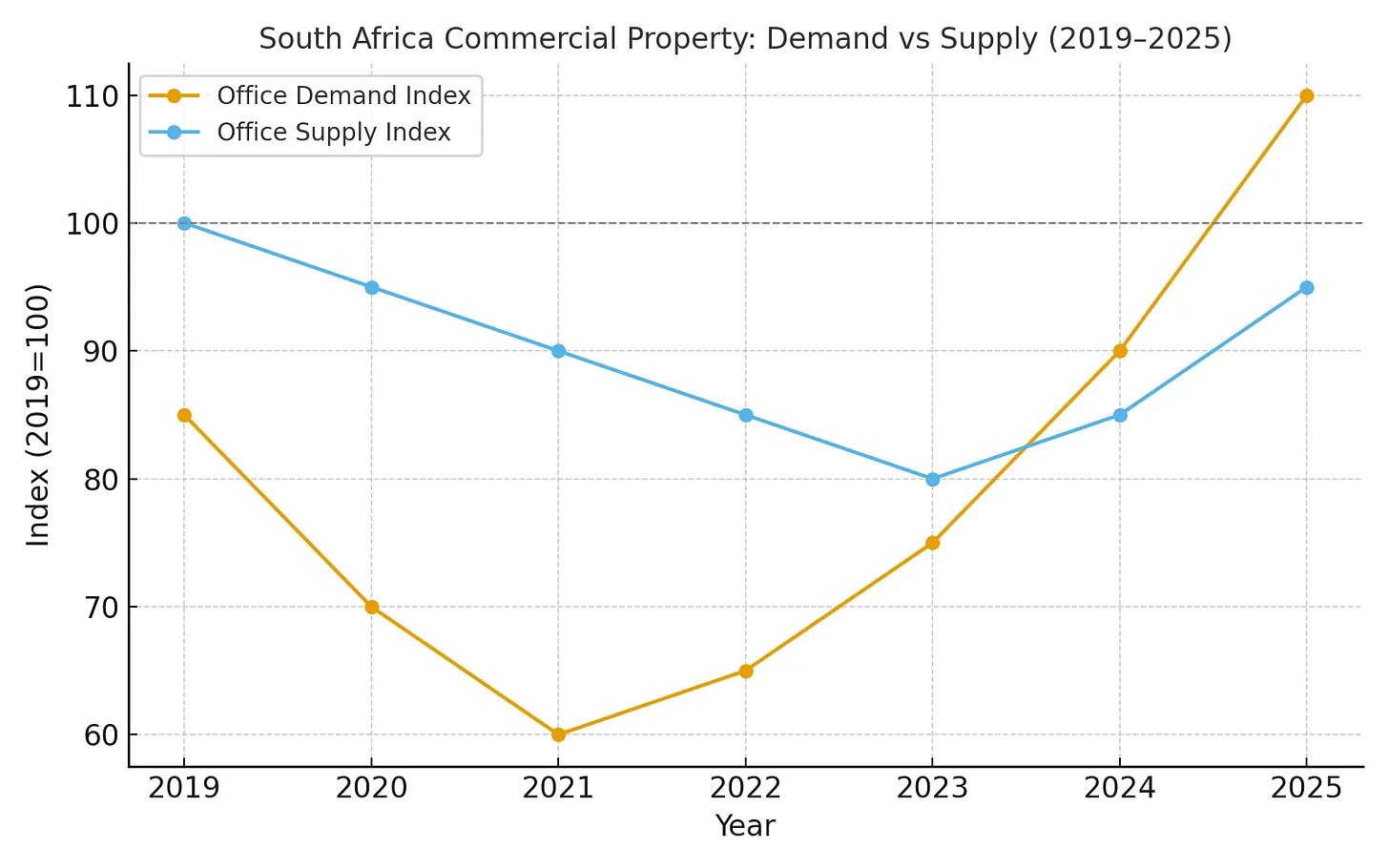

For the first time since 2019, demand has outpaced supply in SA’s commercial property sector.

With rates cooling, investors are sniffing around logistics and office parks again. It’s not a boom, but it’s definitely a switch.

South Africa has the most robust and active commercial real estate scene on the continent, and after recent years of softening, things appear to be changing.

Could cheaper debt and stable inflation turn SA’s property cycle from recovery to rally? This may take time and many other factors to come to realization, but things seem to be getting better slowly.

SMALL CHOP

🎨 Entertainment Week Africa Turns Up in Lagos

Lagos just wrapped its biggest creative summit yet, Entertainment Week Africa 2025, connecting musicians, filmmakers, and investors.

The six-day, multi-venue festival put Lagos, Nigeria, front and centre (rightly so) of the rising creative economy sector in Africa.

Big shots like Don Jazzy, Tiwa Savage, Yemi Alade, and many more made appearances and highlighted the importance of a cohesive industry that is still in its infancy.

There is so much creativity and innovation on the continent, and Africans all over are making huge impacts across the world.

Events like this are essential to keep momentum, bring deals together, and promote the African creative economy to the world, not to mention the big impact it has on GDP.

DISH OF THE DAY

AMALA

Since we were in Lagos for the Entertainment Week Summit, our bellies were primed to eat our fill. And we did.

The food scene in Lagos is amazing. From the bukas to the top-tier restaurants, you can find anything you like. We focused on Amala.

Amala is a delicacy of the South-Western region of Nigeria and is part of the cultural identity of the Yoruba people.

It’s a smooth (swallow) made from cassava or yam flour that is smooth and has a dark colour.

It is paired with soups and stews such as ewedu and other soups of your choice. It is more than a meal, but an experience, and we indulged completely.

Did You Know? Africa produces about 70% of the world’s cocoa, 50% of cashews, and 10% of coffee, yet most of it’s exported raw. If more was processed locally, Africa could earn four times more from the same crops.

Till next time,

Chop Team